Quick Answer: This post offers information on how to register for a sales tax permit in Oklahoma. Registration is best completed online via the Oklahoma Taxpayer Access Point website. More detailed information is included below.

Registration Fee: The sales tax permit registration fee in Oklahoma is $20.00. It's $10.00 for each additional location.

Renewal Required?: Sales tax permit renewal is automatic every 3 years from permit start date in Oklahoma.

Turnaround Time: In Oklahoma, it takes 2-4 weeks. Wait for mail.

The first step in registering for a sales tax permit is determining if you even need one. In general, you need a sales tax permit in Oklahoma if you have a physical presence or meet economic nexus requirements. For more detailed information on the necessity of getting a permit, you can learn more at our blog post “ Do You Need to Get a Sales Tax Permit in Oklahoma? ”

If you are not sure where you should get sales tax permits, we can help determine that for you with our Sales Tax Starter Kit Service .

Once you’re sure you need a sales tax permit in Oklahoma, you can proceed with registering.

Oklahoma offers two types of sales tax permits, the Sales Permit and the Vendor Use Permit. For the purpose of this blog, we will be discussing the Vendor Use Permit. Follow this link to read up and understand the two different types of permits.

If you’re already feeling a little overwhelmed, you should know that we can handle the entire permit registration process for you with our Sales Tax Permit Registration Service .

Currently, there is no charge for a Vendor Use Permit in the state of Oklahoma.

There is, however, a $20 charge for applying for the Sales Permit with the state of Oklahoma.

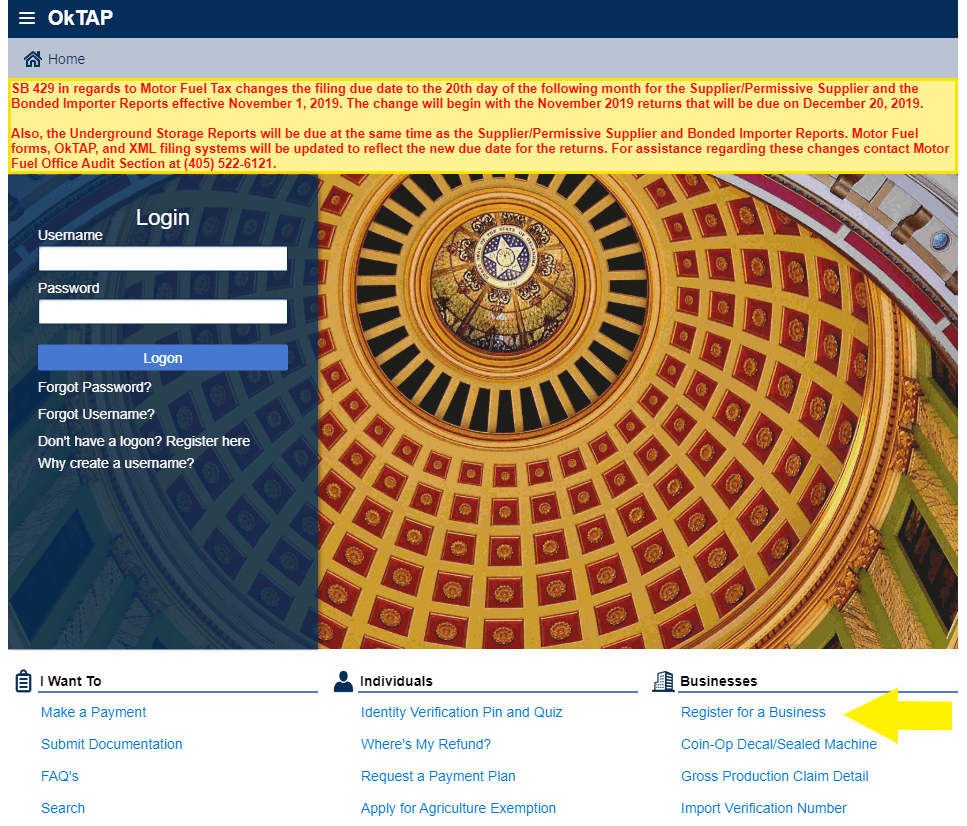

The best place to register for a sales tax permit with the state of Oklahoma is on their website at https://oktap.tax.ok.gov/OkTAP/Web/_/ .

If you are stuck or have questions, you can either contact the state of Oklahoma directly or reach out to us and we can register for a sales tax permit on your behalf.

How to contact the Oklahoma Tax Commission if you have questions: You can contact the Oklahoma Tax Commission by calling (405) 521-3160.

How to contact TaxValet if you want someone to handle your permit registration for you: You can learn more about our sales tax permit registration service by clicking here .

To get started, choose the link titled “ Register for a business ” on the website.

The Oklahoma Taxpayer Access website will ask if you are a remote seller. A business applying for the Vendor Use Permit will likely need to select “ Yes .” After making your selection, follow the prompts to complete your online registration.

The Oklahoma sales tax permit application is a very short application. You might feel like you did something wrong because it is so short. Don’t worry. You are likely right on track.

Keep in mind, once you have an active sales tax permit in Oklahoma, you will need to begin filing sales tax returns. Our team can handle your sales tax returns for you with our Done-for-You Sales Tax Service . You can also learn more about how to file and pay a sales tax return in Oklahoma by clicking here .

Your Oklahoma Vendor Use Permit and registration letter should arrive in your mailbox within 7-10 business days.

Once you receive your vendor use permit in the mail, you will go to https://oktap.tax.ok.gov/OkTAP/Web/_/ to create your online account.

You will click on “ Don’t have a login? Register here ” to create your online profile. After you have completed the information, click “ Next ” and this will take you to the account information screen. Enter the requested information from your registration letter. You will then gain access to your account.

Oklahoma Vendor Use permits do not expire.

If at any point you are stuck and want a team of experts to handle all of this for you, don’t hesitate to contact us .